25 Jun Avoiding Probate with a Transfer-on-Death Deed

If you want to leave your home to your children or other heirs and keep the property out of the costly and time-consuming probate process, you could place your home in a living trust. Trusts offer numerous advantages, but they incur up-front costs, often have ongoing administrative fees, and involve a complex web of tax rules and regulations.

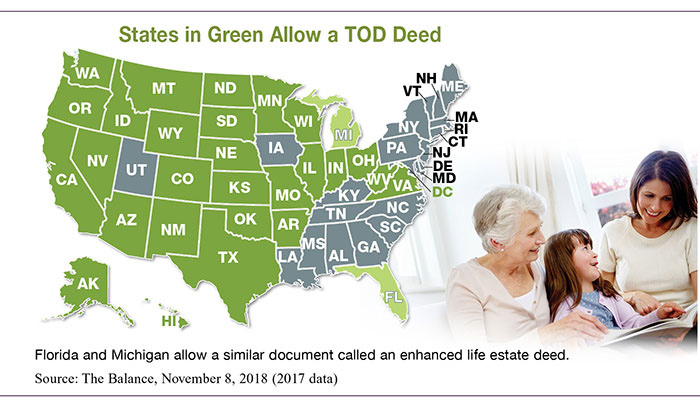

More than half of U.S. states now offer a simpler and less expensive way to avoid probate: a transfer-on-death (TOD) deed (also called a beneficiary deed). As the name suggests, this is a legal document that directly transfers ownership of the property from you to your designated beneficiaries upon your death. You retain full ownership and control while you are alive, and your beneficiaries have no rights to the property until after your death. (Beneficiaries also inherit any associated financial obligations, such as a mortgage or lien.)

The TOD deed is filed with the appropriate land office, so it cannot be lost or misplaced. The deed would supersede your will, so be sure the provisions of your will match the deed. If you change your mind, the deed can be revoked and/or replaced through a new filing. As with all beneficiary documents, you should designate contingent beneficiaries in the event that a designated beneficiary predeceases you.

In some states, a married couple who own a home together through joint tenancy or as community property with right of survivorship would each have to complete a TOD deed. The deed for the first spouse who dies would become void, and the deed for the second spouse would transfer ownership to the designated beneficiaries.

Estate and Capital Gains Taxes

A TOD deed does not remove the property from your taxable estate. However, because of the high federal estate tax exclusion amount ($11.4 million in 2019, $22.8 million for a married couple), very few estates may be subject to federal estate taxes.*

If your heirs sell your home, they could be subject to capital gains taxes regardless of whether they receive the property through a living trust or a TOD deed. However, the step-up in basis provision of U.S. tax law automatically sets the basis as the fair market value of the home at the time of your death, effectively eliminating all capital gains up to that time. Your heirs could shelter $250,000 of gains ($500,000 for a married couple) if they live in the home for two out of five years before selling.

Although you do not need an attorney to execute a TOD deed in most states, you may want to consult an attorney who is familiar with the laws of your state. You should definitely consider the counsel of an experienced estate planning professional and your legal and tax advisers before implementing trust strategies.

*In 2026, the federal estate tax exclusion is scheduled to revert to 2017 levels ($5.49 million, $10.98 million for a married couple), indexed for inflation.

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2019 Broadridge Investor Communication Solutions, Inc.