02 Nov Help with College: A Gift for Your Grandkids

College graduates generally earn more, have lower rates of unemployment, lead healthier lifestyles, and are more active citizens than those without a degree.1 One estimate places the lifetime value of a bachelor’s degree at $2.8 million.2

That kind of opportunity requires a substantial investment that can be overwhelming even for families who are on solid financial ground. For the 2017–18 academic year, the average annual cost for tuition, fees, room, and board was $20,770 at a four-year public university and $46,950 at a nonprofit private university.3

Helping a grandchild obtain a college degree could be life-changing for the student and bring joy to you as well. However, to maximize the gift, it’s important to consider the potential ramifications for student aid and taxes.

Consider the FAFSA

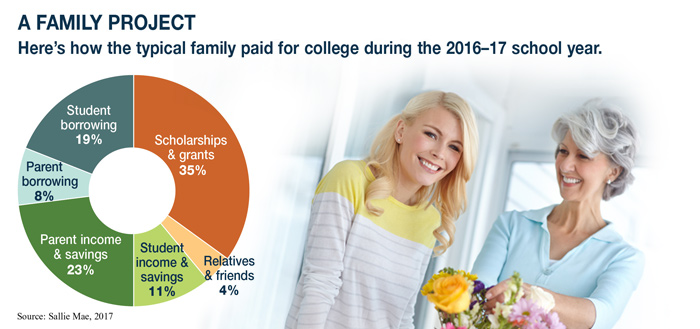

The Free Application for Federal Student Aid (FAFSA) is the standard application for need-based student aid. Some schools also require additional, more detailed applications. A direct gift to your student would be included under the student’s income and savings on the FAFSA and may have an outsized effect on aid.

Depending on the size of your gift and the student’s other sources of funding, you might consider waiting until his or her senior year of college, after all financial aid has been finalized. Or you could wait until graduation and help pay back student loans.

Giving to the parents rather than the student is also an option. Parent resources must be entered on the FAFSA but generally count for significantly less than student resources in financial aid calculations. Under the federal aid formula, students must contribute 20% of their assets each year toward college costs, and parents must contribute about 5.6% of their assets or less, depending on their situation.

Gift Taxes

The gift tax would probably not be an issue unless you plan very large gifts over your lifetime. In 2018, you may contribute $15,000 ($30,000 combined if you’re married) to any number of individuals without being subject to the gift tax. Gifts above the annual exclusion may be applied toward the combined lifetime gift and estate tax exemption, which is $11.18 million in 2018 ($22.36 million for a married couple). Tuition (but not room and board charges) paid directly to the school is not subject to the gift tax, but any such payments would likely reduce need-based financial aid.

Be sure to consult a tax professional if you have questions about gift or estate taxes.

1, 3 College Board, 2016, 2017

2 Journal of Financial Planning, February 2018

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2018 Broadridge Investor Communication Solutions, Inc.