25 Jul New Study Finds Widespread Job Loss After 50

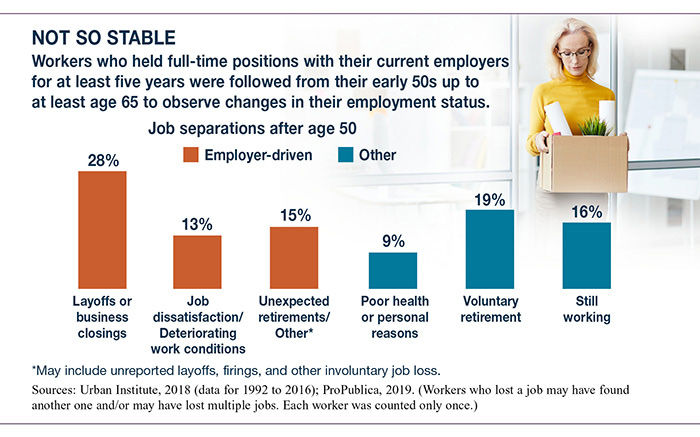

Research conducted by the Urban Institute suggests that many people with apparently stable positions face a job loss after age 50 with serious financial consequences.1

Analyzing data from the University of Michigan Health and Retirement Survey — a long-term survey of Americans ages 51 and older — researchers found that about two-thirds of people in their early 50s who were working in a long-term, full-time job lost their jobs involuntarily before reaching age 65, and then remained unemployed for six months or more or took a pay cut of 50% or more to accept other work. More than half left due to employer-driven issues including layoffs, business closings, or deteriorating work conditions such as reduced hours, pay, or benefits; lack of promotional opportunities; or problems with supervisors or co-workers.2

As the statistics illustrate, older people who lose a job often have a harder time finding new employment, and when they do the pay may be significantly lower, especially for those who were high earners at the peak of their careers. Only one out of 10 workers who lost their jobs due to employer-related conditions ever earned as much as they did before the separation.3

It’s not always possible to foresee changes in the workplace, so it never hurts to think ahead. Here are some steps you can take to prepare yourself for a possible challenge to your career.

Keep your skills up-to-date. Many older workers who are highly experienced in traditional skills and processes may fall behind as new knowledge and technology are required in the workplace. Keeping your skills up-to-date through reading, on-the-job training, and/or continuing education can make you more valuable to your current employer and put you in a stronger position if you have to look for another job.

Build your network. Maintaining and developing contacts through social activities, conferences, professional organizations, and other networking opportunities can pay dividends in your current job and become a lifeline if you have to look for a new one. The fellow professional you help today might help you tomorrow.

Save as much as you can while you can. Your 50s and early 60s — when your children may be independent and your earnings may be high — is an ideal time to sock away extra cash in an emergency fund and build your retirement savings. A common guideline is to have an emergency fund that could last at least six months, and more would be better. Maximize tax-advantaged retirement contributions if you can, and put more away in other accounts if possible. If your savings are strong enough, you may be able to retire early in the event of a job loss.

1–3 Urban Institute, 2018

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2019 Broadridge Investor Communication Solutions, Inc.