02 Jul Steps to Executing an Exit Strategy

Some business owners don’t think about succession possibilities or when they might retire, because they love running their companies and don’t want to stop any time soon. But unfortunately, about half of retirees must stop working earlier than expected, often due to health problems or to care for an ailing spouse.1

Succession plans are designed to ensure the orderly transfer of a business from the current owners to the next generation and to provide a way for the owners to cash out. Monetizing a closely held business is often a long and difficult process, so you may benefit from planning an exit strategy well before you really need one.

1. Set a target. Start the process by coming up with a realistic retirement date. Any effort to identify and groom a successor might take longer than you expect. And if you plan to sell your company, it could take several years to find a qualified buyer, begin the ownership transition, and finalize the transaction.

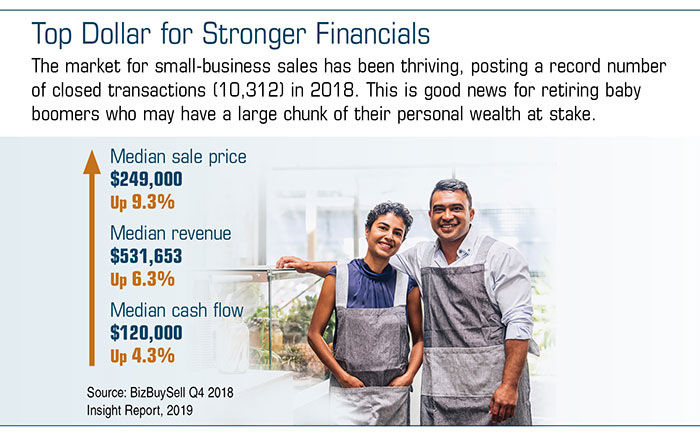

2. Assess the market value. An element of subjectivity means a seller and a potential buyer could draw very different conclusions when assessing a firm’s value, so competing figures might become the starting point for negotiations. To get the best possible price and terms, you may need to improve the company’s balance sheet and clean up the facilities before you start seeking a buyer.

3. Stage your exit. Keeping your business in the family may be an easy decision if an adult child or another relative is willing and able to take over. Otherwise, you might explore the possibility of selling your business to co-owners, outsiders, or even your own employees. In some cases, closing and liquidating the assets may be the only viable option. Either way, you may want to prepare for your retirement by removing certain personal assets from the books.

4. Invest outside of your company. What would happen if you needed to leave the business suddenly and/or the sale price was less than you had hoped? Making annual retirement plan contributions could help insulate your personal financial picture from risks associated with your business’s distinct market. Building a separate investment portfolio might also provide greater flexibility during and after a period of ownership transition.

One never knows what the future has in store. Even the happiest and healthiest business owners might be glad they prepared for retirement.

1 Employee Benefit Research Institute, 2018

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2019 Broadridge Investor Communication Solutions, Inc.