Artificial Intelligence is intelligence that is developed to synthesize, perceive, infer, and perform a wide array of tasks. Found within the field of AI are three primary types known each as narrow, general, and super-intelligent. Artificial Narrow Intelligence, performing a specific task at a high level that any human would be capable of doing. Artificial General Intelligence, broadly intelligent AI that can perform at human cognitive abilities. Artificial Super Intelligence, full machine self-autonomy at a cognitive level greater than that of anything found on earth currently. Why is this an important distinguishment to make? Artificial intelligence has become a loosely defined vague term that can potentially oversell the reality of the product or methods being developed. Take the three types I just mentioned, there are drastic differences in abilities between the three. However, there are still revolutionary technologies being created within field that have the potential to shift the course of history and there always has been.

When it comes to the time horizon of artificial intelligence development it is hard to predict. However, one thing that seems almost certain is that development within the field grows at an exponential rate, as do many types of technology. Slow progress will occur and then out of nowhere a breakthrough will develop. As it pertains to recent events and sentiment surrounding the stock market, is the growth justified or has it got ahead of itself? Arguments for and against can be found in every corner of the internet as the talk heats up more every day.

The Hype is Building

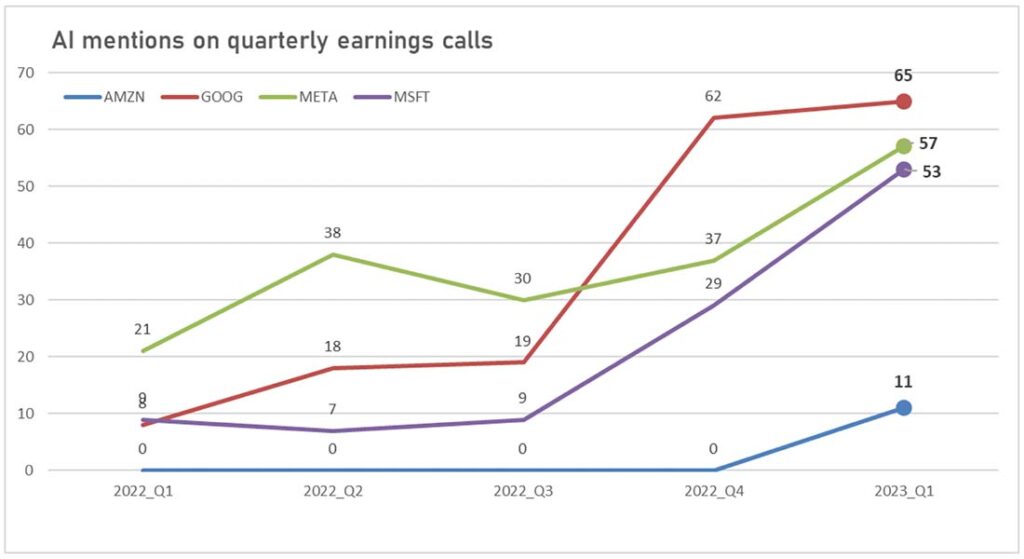

So far as of May 5th, 2023 there have been 1,072 mentions of the term artificial intelligence during earnings season. To visually demonstrate this phenomenon we asked Uptrends.ai to chart the mentions of AI on the earnings calls of Amazon, Google, Meta, and Microsoft from Q1 2022 to Q1 2023. The results speak for themselves.

Artificial Intelligence has and will continue to add real use cases and value for society in a variety of ways. One of the central arguments regarding artificial intelligence is that it will increase the efficiency of business. According to a report from McKinsey & Company, out of the companies they had surveyed a quarter of the respondents reported that at least 5% of EBIT (earnings before interest and taxes) was attributed to artificial intelligence during 2021. In the same report McKinsey & Company found that cost decreases attributable to AI benefited supply chain management, service operations, and finance the most. When it came to revenue increases, they found that marketing and sales, product and service development, and again finance were the biggest beneficiaries.

Artificial Intelligence has and will continue to add real use cases and value for society in a variety of ways. One of the central arguments regarding artificial intelligence is that it will increase the efficiency of business. According to a report from McKinsey & Company, out of the companies they had surveyed a quarter of the respondents reported that at least 5% of EBIT (earnings before interest and taxes) was attributed to artificial intelligence during 2021. In the same report McKinsey & Company found that cost decreases attributable to AI benefited supply chain management, service operations, and finance the most. When it came to revenue increases, they found that marketing and sales, product and service development, and again finance were the biggest beneficiaries.

In another article by Anand Rao of PwC, he discusses how development in artificial intelligence has the potential to contribute up an estimated $15.7 trillion to the global economy by 2030. The two main beneficiaries being China at $7 trillion and the United States at $3.7 trillion.

As society continues to progress it becomes more apparent that we are moving into a digital age. Why does this matter? A further shift into digitization means more technological integration which means more data generated. An AI needs data to learn, without it there is no real way to develop such an intelligence. Like humans, without the outside stimuli (data) we would not have learned to become who we are today. The more and better data an artificial intelligence can be trained upon the better they can learn, perform, and overall become more intelligent.

There is an infinite amount of evidence that points towards a progressing shift into a continued technological age, here are a few pieces of evidence we use. According to Harvard Business Review, 97% of all money in circulation today can be found digitally in the form of binary string code. Cash transactions continue to fade as society moves to the preferable digital transaction. Kepios, found that global internet usage reached 5.181 billion users as of April 2023. Along with this, many of the developed nations globally boast internet penetration rates above 90%. At the same time, other developing nations continue to grow each year such as China who has grown from a lower than 40% penetration rate in 2010 to a near 75% penetration rate in 2023. The overarching theme of these data points suggests that we are moving further into an already digitized society. And again, the greater this phenomenon becomes the more data artificial intelligence can gather to train upon. The more powerful these systems become the greater the benefit they can potentially provide to society and in turn to companies that implement artificial intelligence into their operations.

The largest arguments against the implementation and usage of AI are ethical dilemmas. How do you control something that is smarter than you are and how do you keep it out of the hands of bad actors? Who is in place to oversee these systems are developed and taught properly? How can we know for sure that they are benefiting society?

Among these ethical debates is the scenario of artificial intelligence eventually becoming smart enough to replace human workers. One example of this would be the threat self-driving cars pose to workers in the freight transport industry. What happens to the people who were formerly employed? Is that a real threat currently? You could ask yourself, how far away actually are we from such scenarios? Which leads us to our next point.

Has artificial intelligence gotten away from itself and become overhyped in its current stage? Developing such systems is not something that typically happens overnight, Elon Musk himself stated that her underestimated how hard developing self-driving technology would be. With the rapid rise of generative artificial intelligence new business models and tools are being touted as revolutionary but do they live up to the current sentiment?

In a recent interview with CNBC Roger McNamee, former head of T. Rowe Price Science and Technology Fund, gave his opinion on the subject. Roger stated, “The guys at OpenAI are trying to create the illusion that what they are doing is inevitable. And yet there is no obvious business model, there’s no way to monetize this other than with surveillance capitalism.” Roger also argued that the generative search result tools such as chatGPT do not provide much more value as the results are not identifiable and you still have to fact check the answer yourself, that is if you don’t take it at face value.

In another CNBC interview, Sam Lessin, founder of Slow Ventures, was asked if the new technology was conductive to the startup environment and whether it was hype or justified when it came to the commercial real estate market. “Hype…This boom is really a boom that’s going to be almost completely dominated by the incumbents… I would not expect some sort of silicon valley boom where ya know thousands of startups are going to be super successful and grow to big head counts and need tons of people to drive the commercial real estate story anytime soon.” Lessin also states later in the interview. “ I think that the big thing people are missing about AI is that it really is just an accelerant, a propellant, to a lot of what is already there…I think the big story is that everything gets slightly better and that slightly better can improve margins, it can create consumer experiences but I don’t think there’s a big theme that is completely revolutionized by this.”

Do these statements have merit? For pivotal technological breakthroughs such as generative artificial intelligence one could think there would be a better way to monetize it other than a subscription-based model or surveillance capitalism. As Sam Lessin alluded to, what does your company do when another company can add your core product as just another feature on its already existing successful platform, especially if that platform is free? Many thoughts come to mind.

This is where we feel things get interesting, especially as it pertains to the public markets. Applying the same train of thoughts from above we have recently been asking ourselves whether the current valuations in artificial intelligence related stocks have become overstretched, especially if the underlying product is not as revolutionary as one may think. However, on the flip side how do we identify companies in the artificial intelligence space that do truly have amazing core products, developed AI implementation, and strong execution? Furthermore, where do we look to beyond this recent wave in positive sentiment?

Chui, Michael, et al. “The State of AI in 2022-and a Half Decade in Review.” McKinsey & Company, 6 Dec. 2022, www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai-in-2022-and-a-half-decade-in-review.

Rao, Anand. “PWC’s Global Artificial Intelligence Study: Sizing the Prize.” PwC, www.pwc.com/gx/en/issues/data-and-analytics/publications/artificial-intelligence-study.html.

Mookerjee, Ajay S. “What If Central Banks Issued Digital Currency?” Harvard Business Review, 21 Apr. 2022, hbr.org/2021/10/what-if-central-banks-issued-digital-currency.

Kemp, Simon. “Digital 2023: Global Overview Report – DataReportal – Global Digital Insights.” DataReportal, 4 Feb. 2023, datareportal.com/reports/digital-2023-global-overview-report.

“There’s no evidence today’s A.I. tech will improve our daily lives, says Elevation’s Roger McNamee” uploaded by CNBC Television, May 31, 2023

“Current A.I. boom is not conducive to startups, says Slow Ventures’ Sam Lessin” uploaded by CNBC Television, June 1st, 2023

Wells Fargo Advisors Financial Network did not assist in the preparation of this report, and its accuracy and completeness are not guaranteed. The opinions expressed in this report are those of the author(s) and are not necessarily those of Wells Fargo Advisors Financial Network or its affiliates. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Additional information is available upon request.

FINRA’s BrokerCheck to obtain more information about our firm and its financial professionals